About us

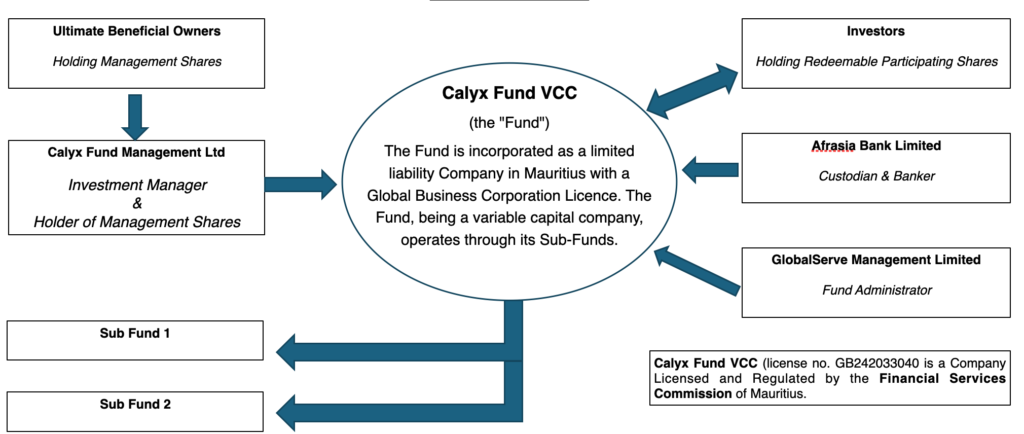

Calyx Fund VCC is a Mauritius-incorporated Variable Capital Company (VCC), managed by Calyx Fund Management Ltd. The VCC structure is governed by the Mauritius Variable Capital Companies Act 2022, which allows for the creation of an umbrella fund with multiple sub-funds and special purpose vehicles (SPVs), each with segregated assets and liabilities.

Calyx Fund VCC is licensed and regulated by the Mauritius Financial Services Commission (FSC), and must comply with the VCC Act, the Financial Services Act 2007, the Financial Intelligence and Anti-Money Laundering Act 2002, and all relevant securities regulations.

Structure Chart

Key Highlights

Risk Segregation

Sub-funds’ assets/liabilities are ring-fenced

Diversification

Multiple strategies and asset classes under one roof

Tax Efficiency

No capital gains tax, no withholding tax, access to DTAAs, partial exemption regime

Cost Efficiency

Shared service providers and single license reduce costs

Transparent

Ability to appoint representative

Confidentiality

No public disclosure of shareholder registers or audited accounts

Flexibility & Liquidity

Easy creation/redemption of sub-funds, flexible capital management

Increase Access

Creating Investment Pools for large investment opportunities

Regulatory Oversight

Strong legal framework and investor protection

Professional Management

Access to experienced, regulated fund managers

Offerings

VT Global Fund

- Constituted as a collective investment scheme and authorized to operate as an Expert Fund.

- A long-only US growth strategy, which aims to outperform the S&P 500.

Calyx India Equity Funds

- Constituted as a collective investment scheme and authorized to operate as an Expert Fund.

- Basket of curated Indian Mutual Funds designed to beat S&P BSE 500 TRI (India Index) with lower volatility.